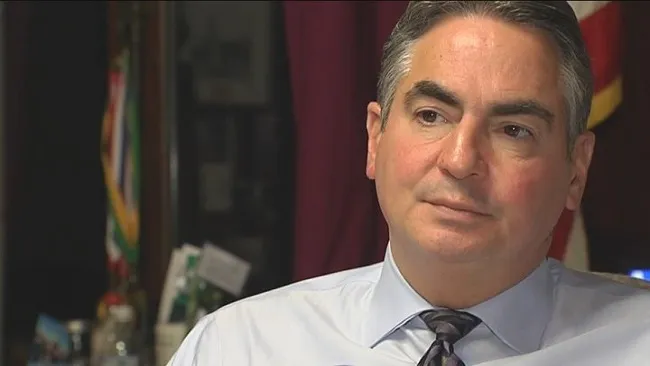

Mayor Domenic Sarno’s administration allegedly unlawfully confiscated an average of $119,000 in home equity from 129 homeowners in the city of Springfield, Massachusetts. In a shocking revelation, a study conducted by the Pacific Legal Foundation has exposed The study, which analyzed tax-foreclosed properties in the state from January 1, 2014, to December 31, 2021, highlights a concerning pattern of property seizures that exceeded the amount of unpaid taxes, leaving property owners with nothing.

Under Springfield’s tax collection system, if a property owner failed to pay or underpaid their property taxes, the city had the authority to take possession of the entire property, including the owner’s equity, which often far exceeded the outstanding tax debt.

This practice diverged from other types of foreclosures where property owners might still retain some equity in their homes after the sale.

The study revealed that Springfield was the most egregious violator of this practice among cities in Massachusetts. Property owners in Springfield who lost their homes due to tax title foreclosure saw their equity seized at a rate almost three times that of Boston and six times that of Worcester. Mayor Domenic Sarno’s administration was accused of confiscating a total of $15 million in home equity from homeowners during the seven-year study period, surpassing Boston’s $12.1 million and dwarfing Worcester’s $4.6 million in equity seizures.

This controversy reached its climax on May 23, 2023, when the United States Supreme Judicial Court handed down a unanimous decision in Tyler v. Hennepin County, clarifying that while local governments have the right to sell a taxpayer’s home to recover unpaid property taxes, they cannot take more property than what is owed. The ruling stated, “The taxpayer must render unto Caesar what is Caesar’s, but no more.”

From the Community, For the Community: Jose Delgado’s Springfield Transformation

Despite this landmark Supreme Court decision, the city of Springfield has not taken any steps to compensate the 129 individuals whose equity it allegedly confiscated unlawfully. Legal experts suggest that the administration’s inaction may lead to extensive litigation and increased liability, particularly when attorney’s fees are considered. A recent case filed in United States District Court, Woodbridge v. City of Greenfield, by an aggrieved homeowner against the City of Greenfield serves as a warning to Springfield of potential legal repercussions if they fail to address the issue promptly.

Ultimately, the burden of this situation falls on the taxpayers, who now face the prospect of footing the bill for an administration accused of profiting from the misfortune of homeowners during their most trying times. The question that lingers is how much taxpayers will ultimately have to pay for the alleged wrongdoing of Mayor Sarno’s administration.